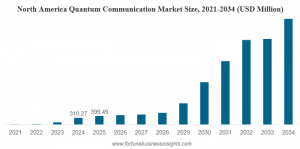

Quantum Communication Market Size to Reach USD 11,973.59 Million by 2034 | CAGR 32.31% (2026–2034)

North America dominated the quantum communication market with a market share of 40.72% in 2025.

Increasing Hybrid Architectures and Miniaturization Lead to New Market Trends”

PUNE, MAHARASHTRA, INDIA, February 3, 2026 /EINPresswire.com/ -- The quantum communication market size 2026 represents a transformative frontier in secure data transmission, leveraging quantum mechanics principles to revolutionize how sensitive information is protected and exchanged. The global market demonstrates robust expansion, driven by escalating cybersecurity threats and the increasing demand for sovereign secure communications across defense, government, and critical infrastructure sectors.— Fortune Business Insights

Market Valuation and Growth Trajectory

The worldwide quantum communication market reached a valuation of approximately 980.90 million dollars in 2025. Projections indicate substantial growth to 1,275.08 million dollars in 2026, ultimately expanding to 11,973.59 million dollars by 2034. This trajectory represents a compound annual growth rate of 32.31 percent throughout the forecast period, underscoring the technology's rapid commercial adoption and strategic importance.

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/quantum-communication-market-112578

Regional Market Leadership

North America maintains dominance in the quantum communication landscape, commanding over 40 percent of the global market share in 2025. This leadership stems from federally funded research initiatives, substantial defense investments, and the region's early adoption of quantum key distribution systems. The United States alone is projected to reach 213.56 million dollars in market value by 2026, supported by government programs prioritizing sovereign key custody and interoperability with existing communication security infrastructures.

Core Technologies and Applications

Quantum communication systems primarily utilize quantum key distribution for aerospace and defense applications, ensuring network security by distributing encryption keys using quantum states. Any interception attempt becomes immediately detectable, allowing for automatic key refresh. The technology encompasses space and ground optical terminals, photon sources and detectors, quantum random number generators, and crypto-agile key management systems with orchestration capabilities.

Primary Market Drivers

Defense programs are transitioning from experimental demonstrations to structured deployments, driven by the need to ensure confidentiality and integrity of mission-critical communications under both classical and emerging quantum threat models. Procurement priorities emphasize sovereign custody of cryptographic material, crypto-agile key management aligned with post-quantum cryptography standards, and assured interoperability across coalition environments. Funding is directed toward national backbone networks, space-to-ground communication links, and mission gateways with defined service levels and rigorous audit requirements.

Market Segmentation Insights

By architecture, the fiber metro and long-haul quantum key distribution segment captured significant market share in 2025, as government agencies mandate tamper-evident keying between data centers and command posts. The space-to-ground segment is projected to expand at a compound annual growth rate of 32.55 percent. In product categories, the security stack segment dominated in 2025, driven by the convergence of post-quantum cryptography rollouts with quantum key distribution pilots. Terminals are expected to grow at the highest rate of 32.79 percent.

Service-wise, integration and maintenance operations held the leading position in 2025, as the complexity of rugged terminals, pointing and tracking systems, and cryogenic detectors necessitates comprehensive lifecycle support. Defense ministries and armed forces represent the dominant end-user segment, prioritizing quantum-secure keying for command, control, intelligence, surveillance, and reconnaissance links across multi-theater operations.

Asia-Pacific Expansion

The Asia-Pacific region is forecast to exhibit the fastest growth, with a projected compound annual growth rate of 33.25 percent during the forecast period. This acceleration is propelled by substantial government investments, particularly from China and India, strong emphasis on cybersecurity enhancements, and rapid advancements in quantum research and hardware development. China's quantum satellite initiatives and India's quantum mission programs exemplify the region's commitment to quantum communication infrastructure.

Competitive Landscape and Key Players

The market exhibits significant consolidation, with leading companies including Toshiba, ID Quantique, QuantumCTek, SES, Thales Alenia Space, Airbus Defence and Space, Honeywell, TESAT, QNu Labs, and BT Group. These industry leaders are investing heavily in miniaturized terminals, enhanced key rates, improved detector and pointing technologies, quantum random number generation, and crypto-agile key management systems. Strategic partnerships with defense ministries, space agencies, and telecommunications carriers are accelerating the conversion of pilot programs into national-scale deployments.

Emerging Trends

Two transformative trends are reshaping the quantum communication landscape: hybrid architectures and miniaturization. Hybrid solutions seamlessly integrate with existing classical networks, combining edge computing, cloud platforms, and on-premises systems to leverage the strengths of each infrastructure layer. Miniaturization efforts are replacing bulky experimental setups with chip-scale platforms, enabling practical deployment across diverse operational environments including airborne and maritime applications.

Market Challenges

Despite promising growth prospects, the industry faces integration complexities, scaling constraints, and supply chain limitations. Achieving multi-vendor interoperability beyond laboratory conditions requires standardized control planes, validated telemetry, and established procedures. Scaling introduces practical challenges including qualified ground site requirements, trained personnel needs, spares positioning, and environmental hardening. Airborne and maritime deployments demand additional stabilization and maintenance capabilities. Supply chains for specialized components such as detectors, cryogenic assemblies, and precision optics remain capacity-constrained, generating lead-time variability and cost pressures.

Restraining Factors

Export controls and sovereignty clauses create fragmentation across international markets. Cross-border deliveries encounter licensing requirements, content origin regulations, and sovereign key custody mandates. These policies necessitate separate product baselines by country, extending approval timelines and increasing development costs. Components including detectors, cryogenic modules, and precision optical elements may require special permits or local manufacturing, further complicating supply chains and delaying multinational collaborative initiatives.

Market Opportunities

Coalition interoperability and defense cloud hardening present significant growth opportunities. Coalition operations require assured cryptographic material exchange under heterogeneous sovereignty and accreditation frameworks, driving demand for interoperable gateway nodes, policy-aware key orchestration, and audited interfaces integrating with national key infrastructures. Defense cloud environments are adopting quantum-safe key pipelines, certified random sources at the edge, and compliance-ready services. Vendors offering validated interoperability, clear certification pathways, and structured lifecycle support are positioned to secure framework contracts and recurring operations revenue.

Recent Industry Developments

Recent strategic initiatives underscore the market's momentum. In October 2025, the European Space Agency contracted with Thales Alenia Space for the SAGA mission, developing a fully European end-to-end quantum key distribution system for governmental applications. In May 2023, TESAT joined the EAGLE-1 consortium as a primary partner to develop and integrate the quantum key distribution payload. September 2024 saw Toshiba, Equinix, and BT Group announce quantum secure connectivity offerings at premium London data centers. These developments reflect the industry's transition from research demonstrations to commercial deployments.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.