Global Less-Than-Truckload (LTL) Market to Surge to USD 333.89 Billion by 2034 | Strongest CAGR to 4.7% (2026-2034)

Less-Than-Truckload (LTL) Market Size, Share & Industry Analysis, By Freight, By Shipment Size, and By Mode of Transportation, By Industry, Forecast, 2026-2034

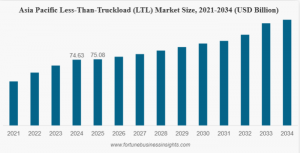

Asia Pacific captured the largest less-than-truckload market share in 2025 and will grow at the highest CAGR within the forecast period.”

PUNE, MAHARASHTRA, INDIA, February 1, 2026 /EINPresswire.com/ -- The global Less-Than-Truckload (LTL) Market has emerged as a cornerstone of modern freight transportation, enabling cost-efficient and flexible movement of goods that do not require full truckload capacity. According to recent industry estimates, the market was valued at USD 220.76 billion in 2025. Continued expansion in global trade, e-commerce penetration, and supply chain optimization initiatives are driving demand for LTL services worldwide. The market is forecasted to grow from USD 231.14 billion in 2026 to USD 333.89 billion by 2034, registering a Compound Annual Growth Rate (CAGR) of 4.7% during the forecast period. This growth underscores the critical role of LTL solutions in bridging the gap between cost and efficiency for shippers, carriers, and end-users across industries.— Fortunebusinessinsights

Get a Free Sample PDF : https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/less-than-truckload-market-115028

Market Dynamics: Rising Demand and Operational Efficiency

The LTL market’s steady growth trajectory is supported by a confluence of factors shaping global logistics and freight transportation. Rapid expansion in e-commerce has significantly increased demand for frequent, flexible freight shipments of small- to medium-sized goods. Traditional FTL (Full Truckload) services often prove cost-prohibitive or impractical for smaller consignments, making LTL a preferred choice for businesses seeking to balance delivery speed and freight costs.

Moreover, advancements in digital freight technologies—such as real-time tracking, route optimization, and dynamic pricing algorithms—are enhancing the operational efficiency of LTL carriers. These technologies enable carriers to maximize load factors, reduce transit times, and offer improved transparency to shippers. Investments in automation at terminals and freight yards further streamline sorting and consolidation processes, increasing throughput while minimizing handling costs.

In addition to technological enablers, strategic partnerships and network expansions are helping LTL companies extend their geographic reach. Cross-border integration and multimodal capabilities are becoming focal points for firms aiming to cater to global supply chain requirements. Sustainability initiatives, including the adoption of low-emission vehicles and consolidation strategies to reduce empty miles, are also influencing service offerings and customer preferences.

Regional Insights: North America Leads, Asia Pacific Emerges

North America continues to hold a dominant share of the global LTL market, driven by a mature logistics infrastructure, large domestic freight volumes, and well-established LTL networks. The United States, in particular, remains a key market with extensive highway systems and high demand from retail, manufacturing, and third-party logistics sectors. Investment in infrastructure improvements and regulatory initiatives supporting freight efficiency are expected to sustain growth momentum in the region.

Asia Pacific, however, is rapidly emerging as a growth hotspot. Expanding manufacturing bases, rising consumer demand, and increased adoption of organized logistics services are propelling the market in countries such as China, India, and Southeast Asian economies. Improvements in intermodal connectivity and warehousing infrastructure are improving the feasibility of LTL operations in regions that historically favored truckload or informal transport solutions.

Europe also contributes significantly to the global LTL landscape. With cross-border trade within the European Union and efficient multimodal networks—including rail and road—LTL services are essential to support intra-regional freight movement. Regulatory emphasis on carbon reduction and digital interoperability among carriers further spurs innovation.

LIST OF KEY LESS-THAN-TRUCKLOAD COMPANIES PROFILED

The competitive landscape of the global LTL market is defined by established carriers with extensive networks, technological investments, and diversified service portfolios. The following companies are at the forefront of innovation and market expansion:

Old Dominion Freight Line (U.S.) – A leading LTL carrier in the United States, known for reliable service performance and extensive distribution networks.

FedEx (U.S.) – A global logistics giant offering a broad spectrum of freight solutions, including advanced LTL services backed by global infrastructure.

DSV (Denmark) – A major European logistics provider with comprehensive freight services, integrating LTL with global transport solutions.

Kuehne+Nagel (Switzerland) – A world-class logistics firm focusing on integrated transport services that include efficient LTL options.

Transport Corporation of India Ltd. (India) – A prominent Indian logistics company expanding LTL and freight consolidation services across domestic and international routes.

XPO Inc. (U.S.) – Known for technology-driven freight solutions, XPO continues to innovate in LTL with digital optimization tools.

Estes Express Lines (U.S.) – A privately held U.S. freight company with a strong focus on dependable LTL service offerings.

R+L Carriers Inc. (U.S.) – Offers a diversified portfolio of freight services with a significant footprint in LTL operations.

AAA Cooper Transportation (U.S.) – Specializes in cost-effective LTL solutions and personalized freight services.

DACHSER (Germany) – European logistics provider combining LTL with global freight integration, emphasizing reliability and network strength.

Get a Free Sample PDF : https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/less-than-truckload-market-115028

Industry Trends Shaping the LTL Market

1. Digital Transformation and Smart Freight

LTL carriers are increasingly adopting digital freight platforms, artificial intelligence (AI), and data analytics to improve load planning, pricing strategies, and customer visibility. These technologies enable carriers to minimize empty runs, optimize routing, and deliver richer analytics to shippers, fostering long-term partnerships.

2. E-Commerce Acceleration

E-commerce continues to redefine freight demand, with smaller, frequent shipments becoming commonplace. LTL services are uniquely positioned to support this trend by offering flexible freight options that align with the distribution needs of online retailers and third-party logistics providers.

3. Sustainability and Green Logistics

Environmental considerations are influencing operational strategies across the LTL market. Carriers are investing in fuel-efficient fleets, alternative energy vehicles, and route consolidation programs to reduce carbon footprints. These initiatives not only meet regulatory requirements but also appeal to eco-conscious customers.

Future Outlook: Strategic Growth and Resilience

The global LTL market is poised for sustained growth through 2034, driven by an interplay of technology adoption, rising freight demand, and strategic expansions by key players. As industries continue to navigate complexities in supply chains, the versatility and cost-effectiveness of LTL services will remain vital. Market participants that prioritize digital capabilities, environmental stewardship, and customer-centric services are expected to lead the next wave of industry evolution.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.