Automated Material Handling Equipment Market Size, Share | CAGR of 10.3%

Automated Material handling Equipment Market size is expected to be worth around USD 103.54 billion by 2032, from USD 47.69 billion in 2024, at a CAGR of 10.3%.

The Automated Material Handling market is projected to surge from USD 47.69 billion in 2024 to USD 103.54 billion by 2032, expanding at a robust 10.3% CAGR driven by e-commerce and automation.”

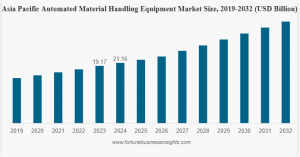

PUNE, MAHARASHTRA, INDIA, September 24, 2025 /EINPresswire.com/ -- The global automated material handling equipment market is on a robust growth trajectory. Valued at USD 47.69 billion in 2024, the market is projected to expand from USD 52.16 billion in 2025 to USD 103.54 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.3%. This expansion is fueled by an increasing demand for rapid and efficient product handling, storage, and sorting, particularly within the e-commerce and automotive sectors. Post-pandemic, many industries have accelerated their shift towards automation to reduce dependency on a physical workforce and boost operational efficiency.— Fortune Business Insights

Get A Sample Report PDF| https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/automated-material-handling-equipment-market-100832

Top Companies

• Daifuku Co., Ltd (Japan)

• Jungheinrich AG (Germany)

• Toyota Industries Corporation (Japan)

• BEUMER Group (Germany)

• Cargotec (Finland)

• Kion Group AG (Germany)

• Crown Equipment Corporation (U.S.)

• Honeywell International (U.S.)

• SSI Schaefer AG (Germany)

• Hytrol Conveyor Company, Inc. (U.S.)

• JBT (U.S.)

• KUKA AG (Germany)

• GreyOrange (India)

• Gridbots (India)

• Addverb (India)

• Dematic (U.S.)

• Aichikikai Techno System (Japan)

• Meidensha Corporation (Japan)

• Rapyuta Robotics (Japan)

• Quicktron (Japan)

Key Drivers / Growth Factors

Several factors are propelling the growth of the AMH equipment market:

• Booming E-commerce and Retail Sectors: The rapid global expansion of e-commerce, driven by increasing online shopping, urbanization, and digital platforms, has created a massive demand for process automation in warehouses and distribution centers. Major players are integrating automated solutions to achieve more precise, cost-effective, and safe operations.

• Manufacturing and Logistics Growth: The manufacturing industry's focus on producing and shipping products faster and at a higher quality necessitates advanced material handling solutions. Furthermore, the significant growth of third-party logistics (3PLs) and warehouses, especially in developing nations, relies on automation for faster task completion, reduced turnaround times, and efficient inventory management.

• Industry-Specific Demands: Industries such as food & beverages, chemicals, and pharmaceuticals prefer AMH equipment to manage large volumes of products, many of which have a limited shelf life and require careful handling.

Challenges / Restraints

Despite the positive outlook, the market faces certain constraints:

• High Initial Investment and Switching Costs: The primary challenge is the substantial capital required for the initial setup. Costs associated with installation, software integration, after-sales services, and ongoing maintenance contribute to a high total cost of ownership, making it difficult for some companies, particularly small and medium-sized enterprises (SMEs), to invest.

• Impact of Tariffs: Increased tariffs can disrupt supply chains and elevate the cost of raw materials and components. While this may limit market growth in the short term, it could also create opportunities for domestic manufacturers as companies localize their supply chain operations.

Opportunities / Future Potential

The market is ripe with opportunities for future expansion:

• Growth in Microfulfillment Centers: The rising demand for microfulfillment centers and 3PLs in emerging Tier II and III cities is set to boost the market. For instance, in India, warehousing stock in these cities accounted for about 18.7% of the total as of February 2025, indicating a strong potential for automation adoption.

• Enhanced Purchasing Power: Growing online platforms and increased disposable income in developing nations are expected to continue driving the demand for automated handling solutions to meet consumer expectations for faster delivery.

Segmentation Analysis

The automated material handling equipment market can be segmented based on type, system load, application, and industry.

By Type

• Automated Guided Vehicle (AGV): This segment is projected to grow at the highest CAGR, thanks to technological advancements like SLAM (simultaneous localization and mapping), AI, and IoT.

• Automated Conveyor & Sorting System: Holding the highest revenue share, this segment is driven by the increasing need for automation in logistics for higher throughput and flexibility.

• Automated Storage & Retrieval System (AS/RS): This segment is expected to see moderate growth, fueled by the increasing number of warehouses and manufacturing facilities globally.

By System Load

• Unit Load: This segment commands the highest market share, largely due to the e-commerce industry's need to handle multiple goods simultaneously to shorten order lead times.

• Bulk Load: The demand for handling bulk quantities in the food & beverage and pharmaceutical industries supports the considerable growth of this segment.

By Application

• Distribution: With the highest market share and growth rate, this segment is driven by the e-commerce industry's focus on timely distribution and transportation to meet delivery targets.

• Packaging: This segment shows steady growth, propelled by demand from the food & beverage, pharmaceutical, and e-commerce industries.

By Industry

• E-commerce: This industry is expected to dominate the market’s revenue share, propelled by rising online shopping trends and the expansion of logistics infrastructure.

Competitive and Industry Insights

The competitive landscape is shaped by prominent players like Daifuku Co., Ltd., Jungheinrich AG, and Toyota Industries Corporation, who hold a significant market share due to their diverse product portfolios and extensive dealer networks. These leaders are actively focusing on expanding their offerings in logistics business solutions to meet the efficiency demands of modern distribution centers.

Recent industry developments highlight this trend:

• March 2025: Nucor Warehouse Systems deployed a 96-foot-tall ASRS cold storage structure in the U.S.

• March 2025: Scott Technology introduced its next-generation AGV, NexBot, designed for various industries including warehousing and logistics.

• December 2024: Coca-Cola announced a USD 44 million investment in its Wakefield manufacturing operations to diversify storage facilities.

Emerging Trends & Technologies

• Industry 4.0 and Smart Factories: The rise of Industry 4.0 is a key trend, with smart factories integrating automated systems for real-time monitoring and improved asset performance through cloud connectivity and data analytics.

• Generative AI: Generative AI is transforming the industry by enhancing operational efficiency, optimizing equipment maintenance schedules, and enabling smart inventory management to reduce turnaround times.

Speak to an Expert | https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/automated-material-handling-equipment-market-100832

Related Insights

Global Material Handling Equipment Market

Automated Guided Vehicle Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.